random thoughts...

Shorted Best Buy (BBY) and Circuit City (CC) today. Two reasons: 1. A picture of an endless line of unsold Ford Explorers (confirmed by the closing of Ojai Ford). 2. A confirmation of consumer weakness in August.

This is an offshoot of the domino strategy. First housing fell, then auto sales. They are both still down and the consumer is weakening further.

Took 18% profit on Seadrill (SDRL.OL). I will look to buy again when oil weakens further.

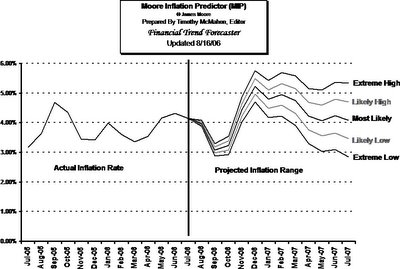

I still see further economic weakening in the next six months. The fed will bail out housing, banking, the consumer, etc., further exacerbating the dollar bubble. Inflation will retrench, and commodities will soar.

In the near future, I think there could be a sharp little correction in the market to price in the coming economic weakness. After that, the market should do very for a few years.